This is the very first isssue of the Dividend Chart Digest! Thank you for being among the first to read it. Any feedback will be highly appreciated 🙂

Regularly, this newsletter will compile for you a selection of the most interesting charts. Let’s dig in!

5 stocks that look attractive

To be considered attractive, stocks that make it to the list need to:

Be yielding more than 90% of the covered period (up to 15 years of history).

Have a consistent dividend track record (no cut or extended slowdown).

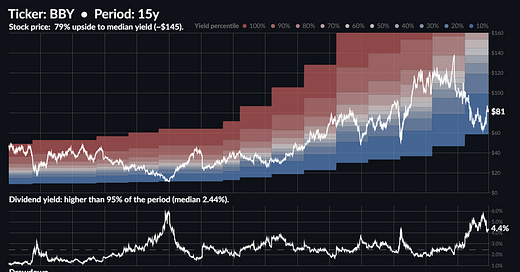

Best Buy BBY 0.00%↑

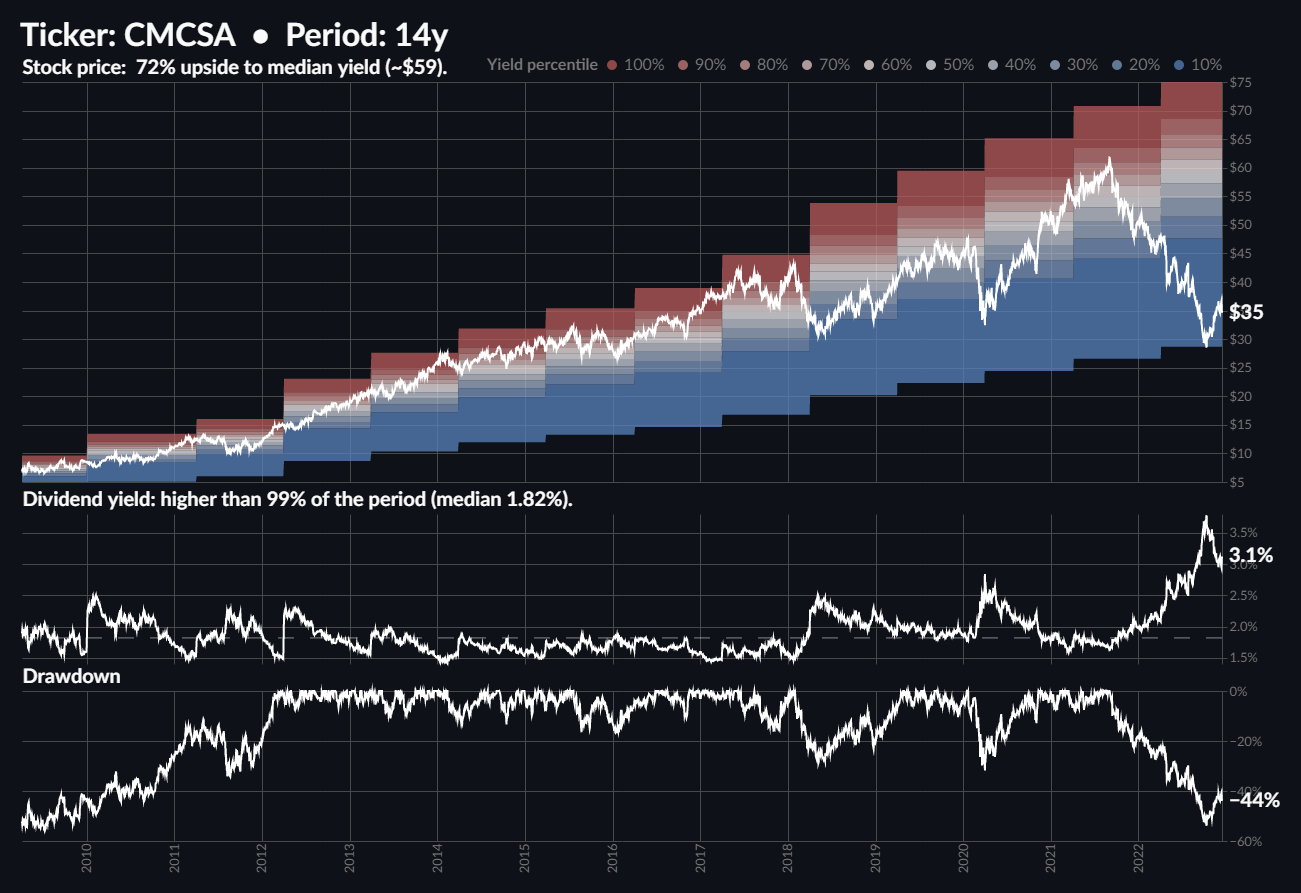

Comcast Corporation CMCSA 0.00%↑

Medtronic MDT 0.00%↑

Verizon Communications VZ 0.00%↑

Visa V 0.00%↑

5 stocks that look expensive

To be considered expensive, stocks that make it to the list need to:

Be yielding less than 90% of the covered period (up to 15 years of history).

Have a long dividend history (no cuts but potentially slowdowns).

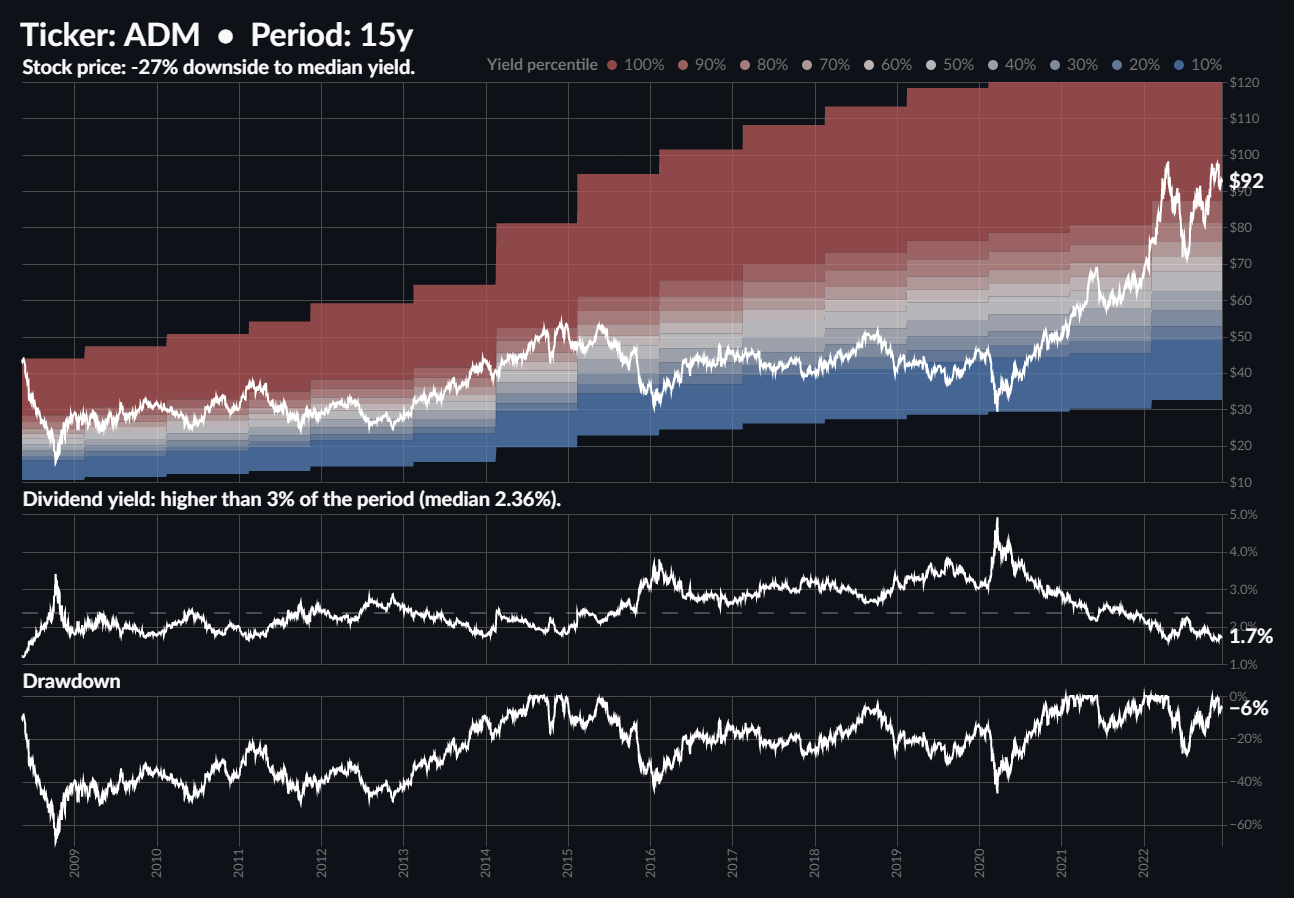

Archer Daniels Midland ADM 0.00%↑

Emerson Electric EMR 0.00%↑

Genuine Parts Company GPC 0.00%↑

Northrop Grumman NOC 0.00%↑

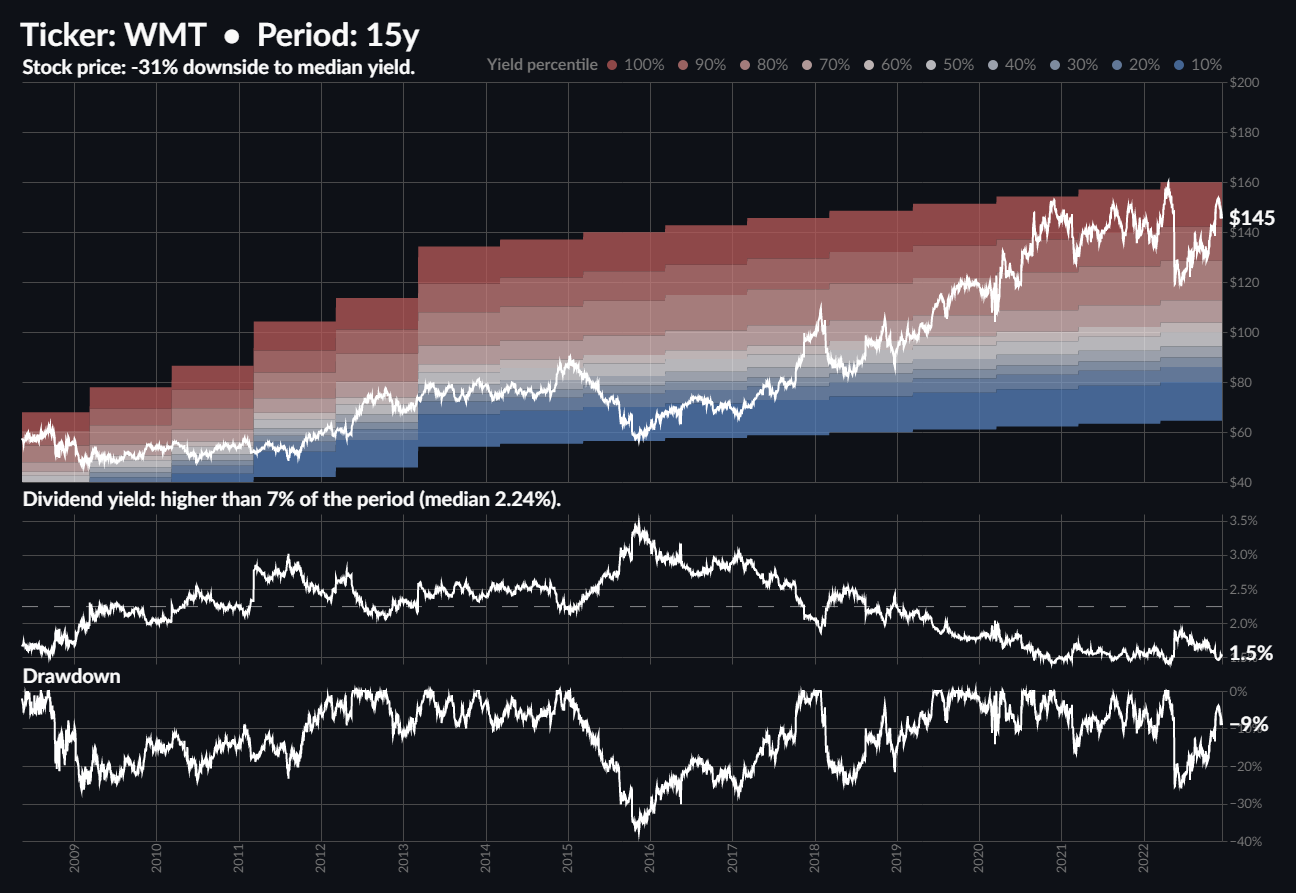

Walmart WMT 0.00%↑

Do not rely on these charts alone to make any financial decision. There is always more to the story.

Ending note

In a little while, I will get back to this list and see how each stock performed.

By the meantime, you can:

Comment and share this post

Subscribe to the newsletter to be the first to receive it

Follow the Twitter Bot @DividendChart to discover more stocks

You can also check my personal account @hugo_le_moine_ where I tweet about my side-projects.

These guys have a paid service, that you provide for free:

https://seekingalpha.com/article/4564416-3-dividend-stocks-to-buy-when-98-percent-of-ceos-predict-a-recession-in-2023

I put their CVX chart from this article, and compared it to yours.

Identical basically.

Their charts show overvalued, undervalued, etc... Where your charts show yield percentile.

Can not attach an image to comment.

Great first article with 5 each of undervalued and overvalued stocks.

Thanks for posting. And keep them coming.