Welcome to the 12th isssue of the Dividend Chart Digest. This newsletter compiles for you a selection of the most interesting charts.

This newsletter is no longer issued on regular basis. Instead, it will be published when I feel like there has been movements on the markets, with special editions in between: focus on ETF holdings, sectors and so on. Stock prices don’t change enough in a week or two to make a real difference on the charts so this way, you won’t see the same again and again.

Now let’s dive into this week selection!

5 stocks that look attractive

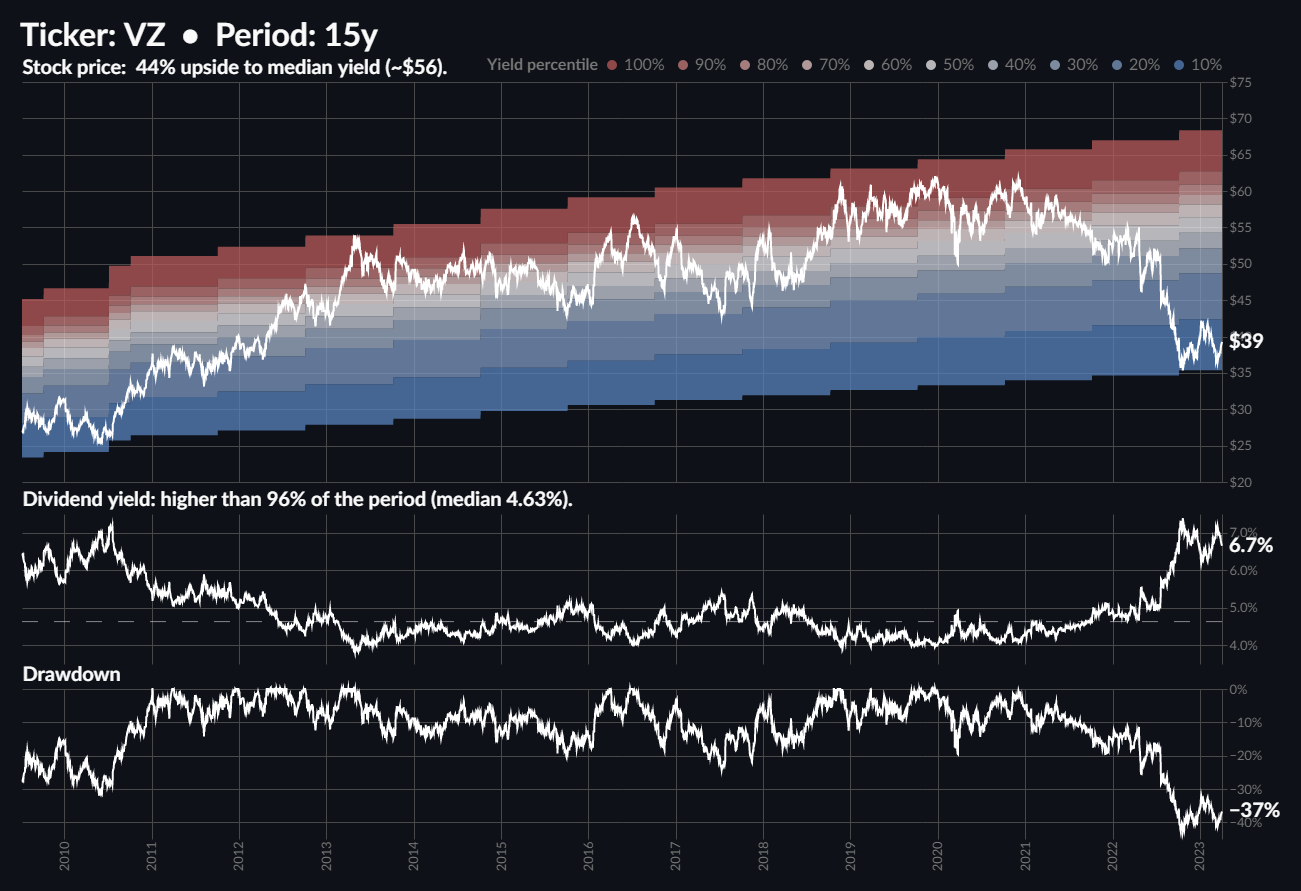

To be considered attractive, stocks that make it to the list need to:

Be yielding more than 90% of the covered period (up to 15 years of history).

Have a consistent dividend track record (no recent cut or extended slowdown).

American Tower AMT 0.00%↑

Extra Space Storage EXR 0.00%↑

Altria MO 0.00%↑

Stanley Black & Decker SWK 0.00%↑

Verizon Communications VZ 0.00%↑

5 stocks that look expensive

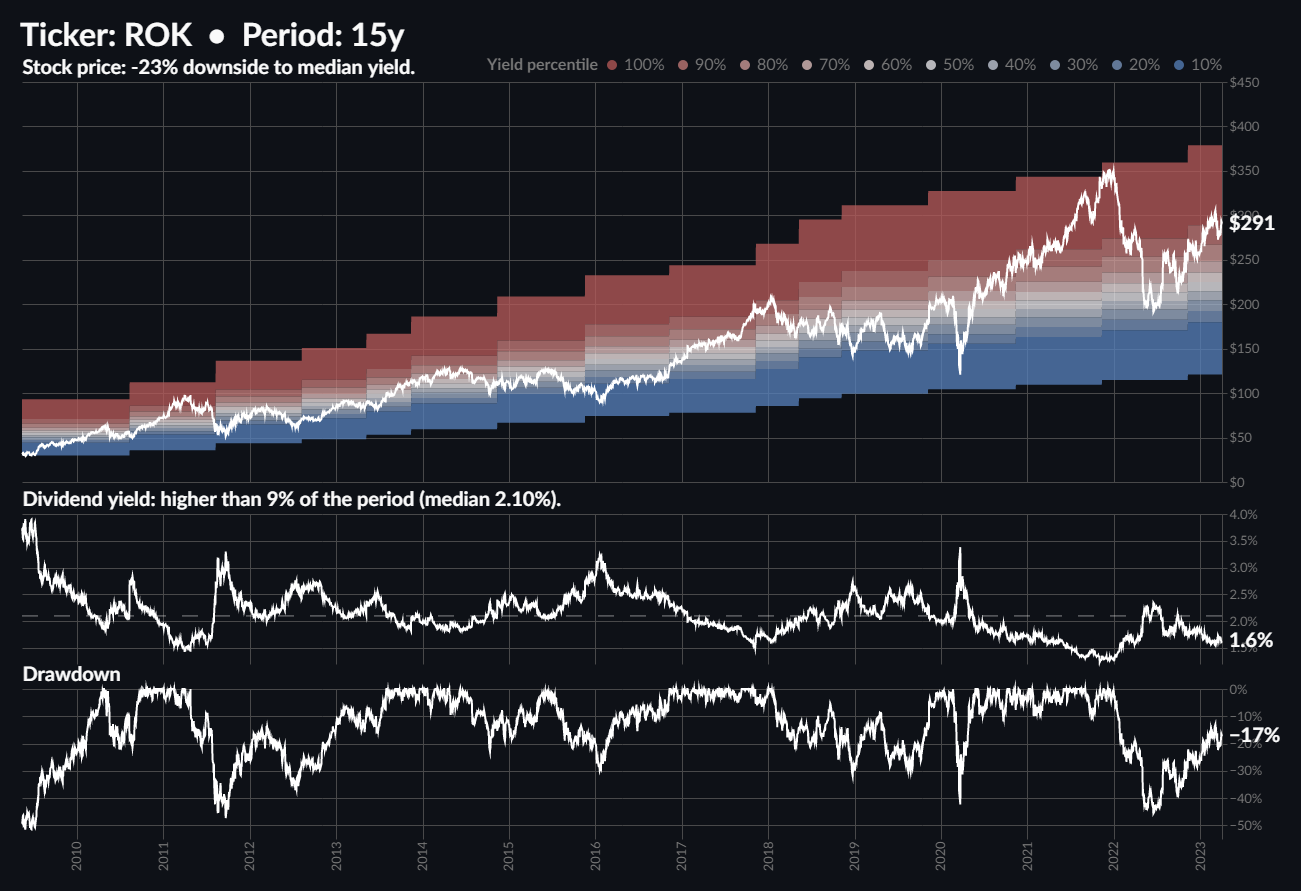

To be considered expensive, stocks that make it to the list need to:

Be yielding less than 90% of the covered period (up to 15 years of history).

Have a long dividend history (no recent cuts but potentially slowdowns).

McDonald's MCD 0.00%↑

Rockwell Automation ROK 0.00%↑

Southern Company SO 0.00%↑

Walmart WMT 0.00%↑

West Pharmaceutical Services WST 0.00%↑

Do not rely on these charts alone to make any financial decision. There is always more to the story.

Ending note

To support this newsletter, you can:

Comment and share this post

Subscribe to the newsletter to be the first to receive it

Follow the Twitter Bot @DividendChart to discover more stocks

You can also check my personal account @hugo_le_moine_ where I tweet about my side-projects.