With a focus on high-quality, dividend-paying stocks and a diversified portfolio spanning a range of sectors, the SCHD ETF offers investors a way to gain exposure to a broad range of dividend-paying stocks.

Managed by Charles Schwab Investment Management, this ETF is a popular choice for those looking for a reliable source of income through dividends. In this post, we'll take a closer look at the top 10 holdings, concentrating more than 42% of its assets.

Top Holdings

As of Market Open 12/19/2022, the top 10 holdings are the following:

Merck & Co Inc ($MRK): 4.8%

Pfizer Inc ($PFE): 4.3%

Broadcom Inc ($AVGO): 4.2%

International Business Machines ($IBM): 4.2%

Amgen Inc ($AMGN): 4.2%

Home Depot Inc ($HD): 4.2%

Cisco Systems Inc ($CSCO): 4.1%

Pepsico Inc ($PEP): 4.0%

Texas Instrument Inc ($TXN): 3.9%

Lockheed Martin Corp ($LMT): 3.9%

Charts

Merck & Co Inc MRK 0.00%↑

Pfizer Inc PFE 0.00%↑

Broadcom Inc AVGO 0.00%↑

International Business Machines IBM 0.00%↑

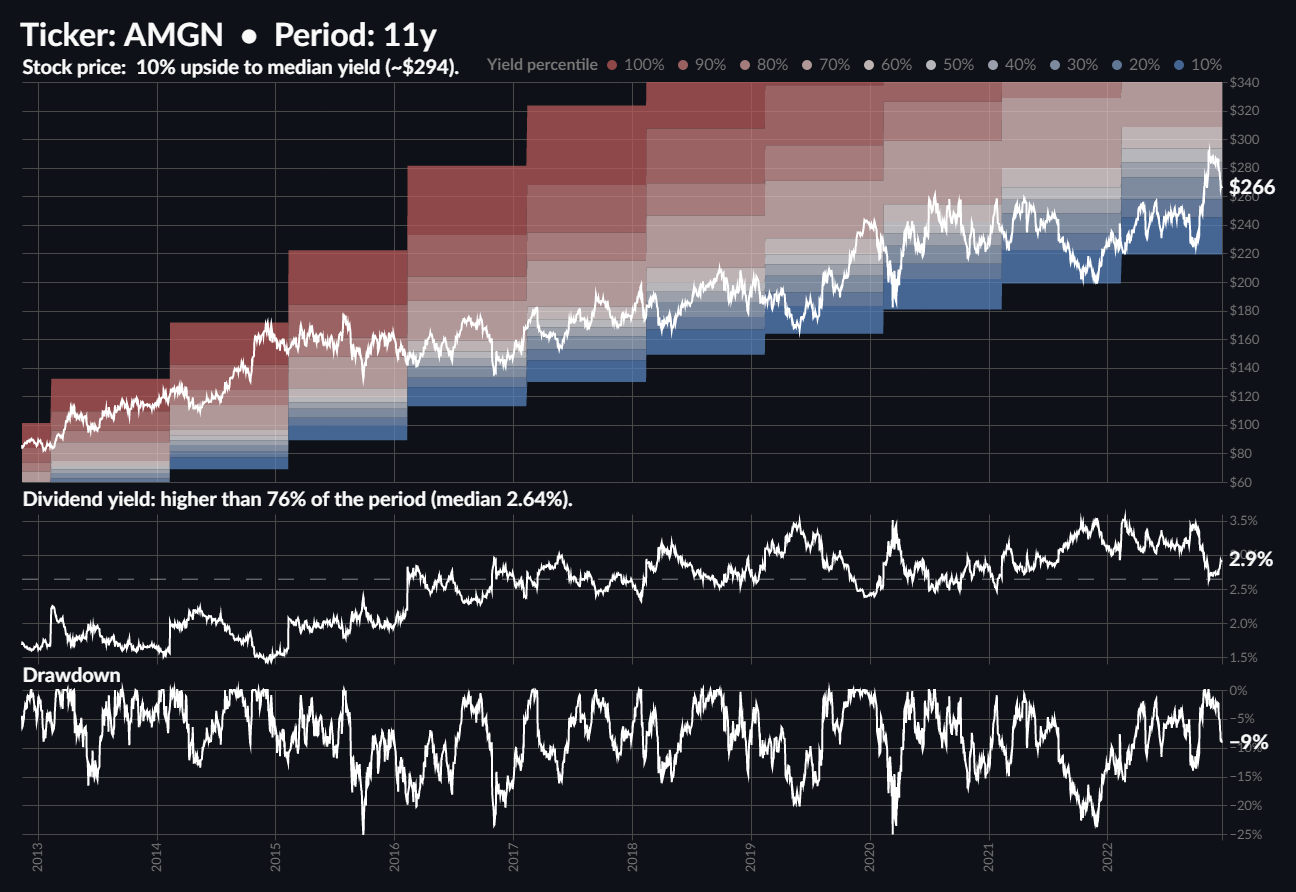

Amgen Inc AMGN 0.00%↑

Home Depot Inc HD 0.00%↑

Cisco Systems Inc CSCO 0.00%↑

Pepsico Inc PEP 0.00%↑

Texas Instrument Inc TXN 0.00%↑

Lockheed Martin Corp LMT 0.00%↑

Do not rely on these charts alone to make any financial decision. There is always more to the story.

These holdings could be categorized as:

Overvalued: MRK 0.00%↑ PFE 0.00%↑ PEP 0.00%↑ LMT 0.00%↑

Fairly valued: AMGN 0.00%↑ HD 0.00%↑ CSCO 0.00%↑

Undervalued: AVGO 0.00%↑ IBM 0.00%↑ TXN 0.00%↑

Ending note

Hope you will find value in this post, any feedback will be appreciated as it would help improving the content I offer on this newsletter. Thanks 🙂

To support my work, please:

Comment and share this post

Subscribe to the newsletter to be the first to receive it

Follow the Twitter Bot @DividendChart to discover more stocks

You can also check my personal account @hugo_le_moine_ where I tweet about my side-projects.

I have owned 9 of the 10 stocks for years. Do not own PFE.

Another good post.