Welcome to the sixth isssue of the Dividend Chart Digest.

This newsletter compiles for you a selection of the most interesting charts. Let’s dive in!

5 stocks that look attractive

To be considered attractive, stocks that make it to the list need to:

Be yielding more than 90% of the covered period (up to 15 years of history).

Have a consistent dividend track record (no recent cut or extended slowdown).

Gorman-Rupp GRC 0.00%↑

Goldman Sachs GS 0.00%↑

Packaging Corporation of America PKG 0.00%↑

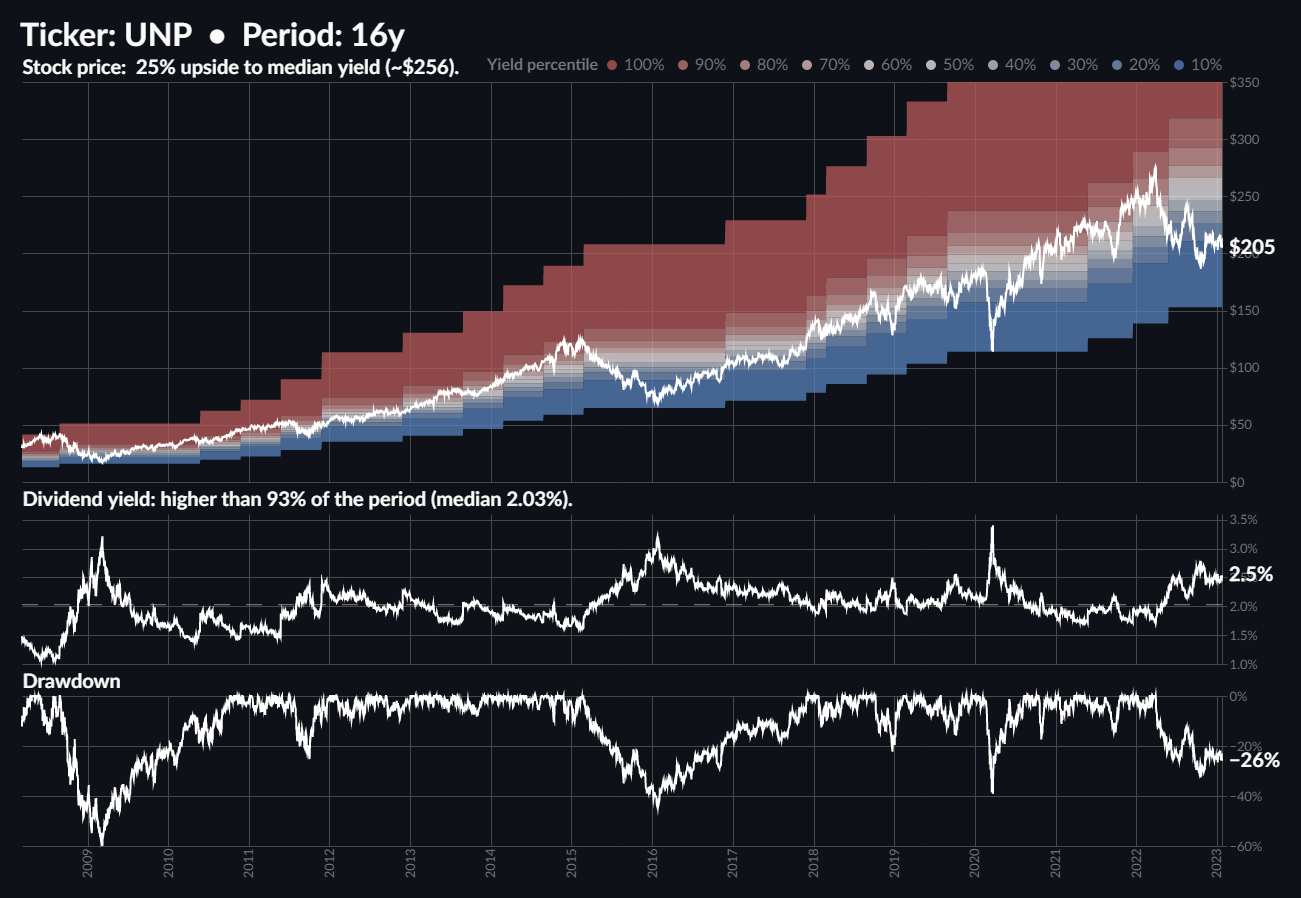

Union Pacific UNP 0.00%↑

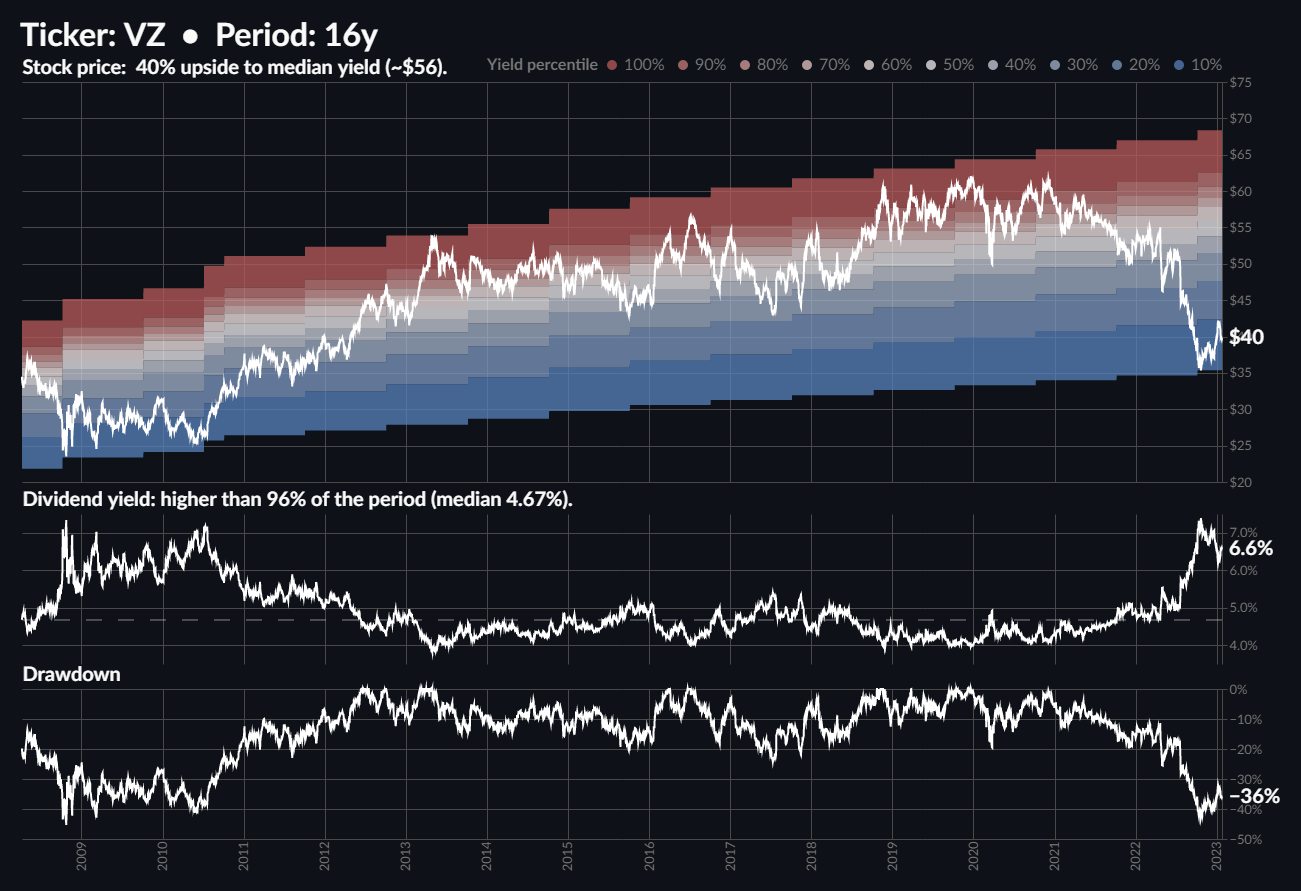

Verizon VZ 0.00%↑

5 stocks that look expensive

To be considered expensive, stocks that make it to the list need to:

Be yielding less than 90% of the covered period (up to 15 years of history).

Have a long dividend history (no recent cuts but potentially slowdowns).

Applied Industrial Technologies AIT 0.00%↑

Badger Meter BMI 0.00%↑

McGrath RentCorp MGRC 0.00%↑

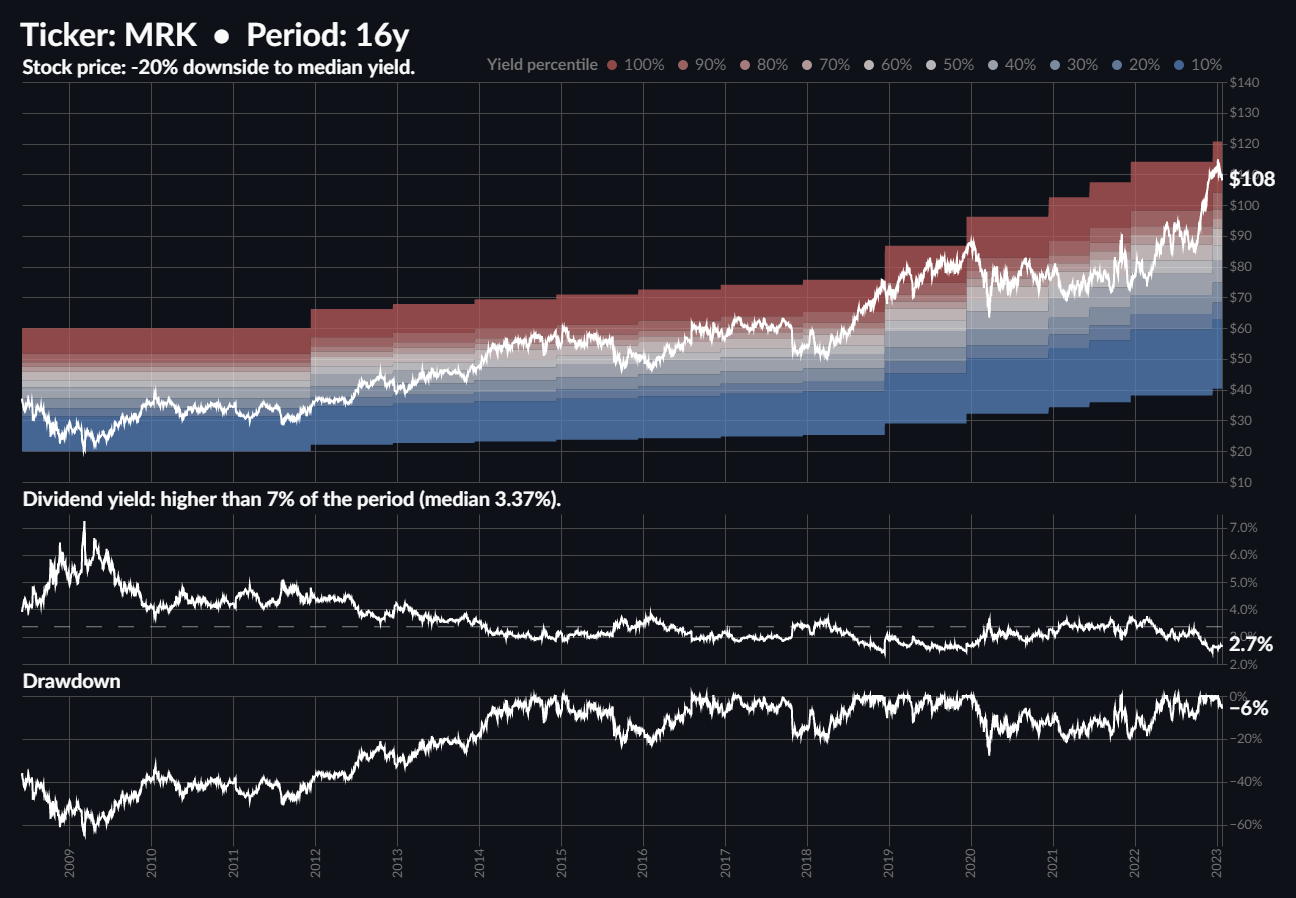

Merck & Co. MRK 0.00%↑

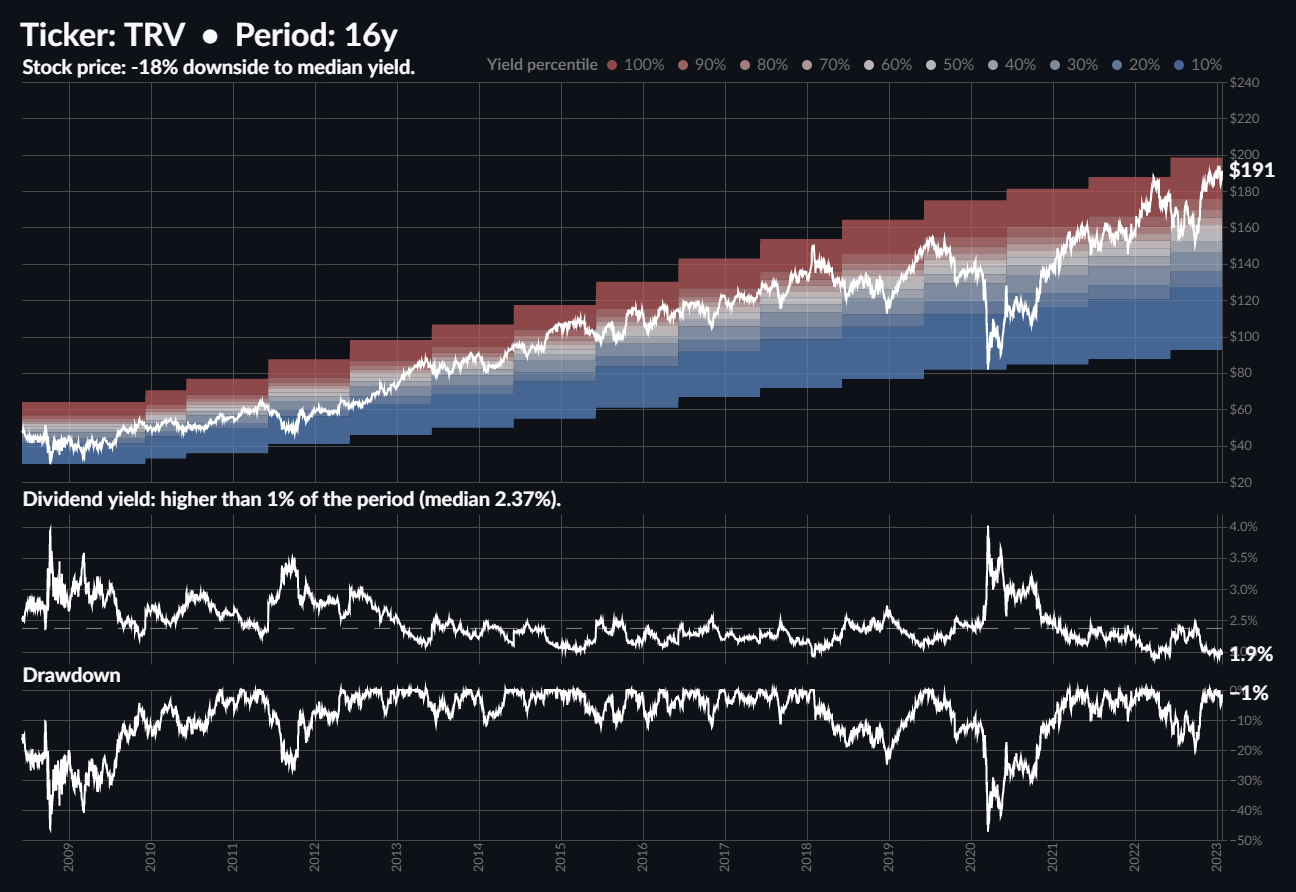

The Travelers Companies TRV 0.00%↑

Do not rely on these charts alone to make any financial decision. There is always more to the story.

Performance Review

Dividend Chart Digest #1 (2022/12/16)

Undervalued stocks performance: +7.37% (BBY CMCSA MDT VZ V)

Overvalued stocks performance: -7.34% (ADM EMR GPC NOC WMT)

Dividend Chart Digest #2 (2022/12/22)

Undervalued stocks performance: +5.85% (HAS LEG TROW TSN UNP)

Overvalued stocks performance: -4.11% (AIT AD ERIE SO TR)

Dividend Chart Digest #3 (2023/01/03)

Undervalued stocks performance: +8.04% (BCPC CE ECL KR TXN)

Overvalued stocks performance: -1.67% (ADM GPC ED DOV SYBT)

Ending note

To support this newsletter, you can:

Comment and share this post

Subscribe to the newsletter to be the first to receive it

Follow the Twitter Bot @DividendChart to discover more stocks

You can also check my personal account @hugo_le_moine_ where I tweet about my side-projects.