Welcome to the 8th isssue of the Dividend Chart Digest. This newsletter compiles for you a selection of the most interesting charts. Let’s dive in!

5 stocks that look attractive

To be considered attractive, stocks that make it to the list need to:

Be yielding more than 90% of the covered period (up to 15 years of history).

Have a consistent dividend track record (no recent cut or extended slowdown).

Amgen AMGN 0.00%↑

Boston Properties BXP 0.00%↑

Crown Castle CCI 0.00%↑

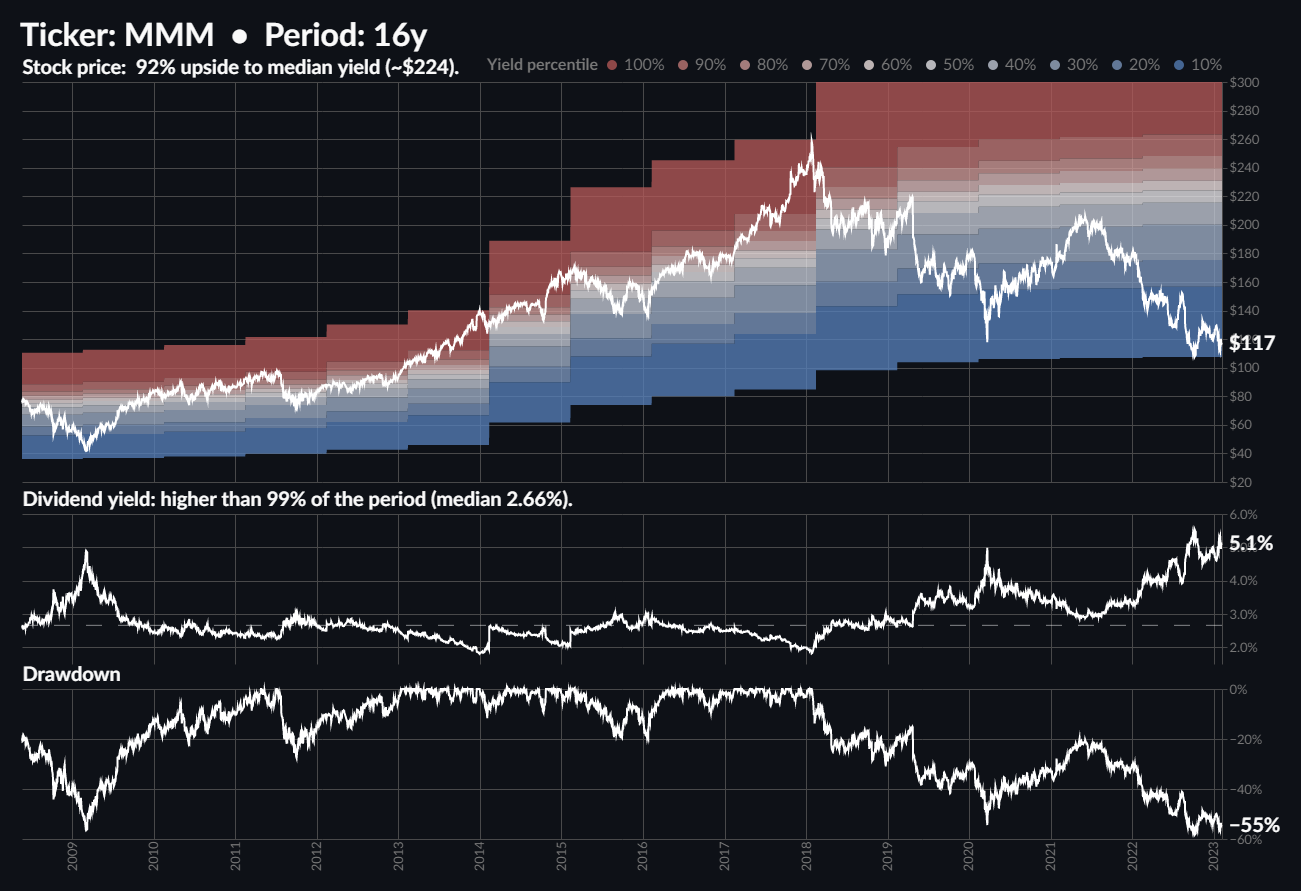

3M MMM 0.00%↑

T. Rowe Price TROW 0.00%↑

5 stocks that look expensive

To be considered expensive, stocks that make it to the list need to:

Be yielding less than 90% of the covered period (up to 15 years of history).

Have a long dividend history (no recent cuts but potentially slowdowns).

Albemarle ALB 0.00%↑

Federated Investors FHI 0.00%↑

Renaissancere Holdings Ltd RNR 0.00%↑

Tootsie Roll Industries TR 0.00%↑

Rockwell Automation ROK 0.00%↑

Do not rely on these charts alone to make any financial decision. There is always more to the story.

Performance Review

Dividend Chart Digest #1 (2022/12/16)

Undervalued stocks performance: +10.66 (BBY CMCSA MDT VZ V)

Overvalued stocks performance: -7.55% (ADM EMR GPC NOC WMT)

Dividend Chart Digest #2 (2022/12/22)

Undervalued stocks performance: +5.75% (HAS LEG TROW TSN UNP)

Overvalued stocks performance: +0.51% (AIT AD ERIE SO TR)

Dividend Chart Digest #3 (2023/01/03)

Undervalued stocks performance: +10.93% (BCPC CE ECL KR TXN)

Overvalued stocks performance: +0.58% (ADM GPC ED DOV SYBT)

Dividend Chart Digest #4 (2023/01/10)

Undervalued stocks performance: +2.18% (BXP FLIC HPQ MO SWX)

Overvalued stocks performance: +0.02% (CB DUK FDS GL TR)

Ending note

To support this newsletter, you can:

Comment and share this post

Subscribe to the newsletter to be the first to receive it

Follow the Twitter Bot @DividendChart to discover more stocks

You can also check my personal account @hugo_le_moine_ where I tweet about my side-projects.